Contents

- What Is Term Life Insurance?

- How to Choose the Best Term Life Insurance

- Factors That Affect

Term Life Insurance

Rates - Riders and Additional Features to Consider

- What Happens When a

Term Life Insurance

Policy Expires? - Common Questions About Term Life Insurance

- Finishing touches have been applied, and we’ve reached the final stage.

The best term life insurance provides financial protection for your loved ones in the event you die. Imagine knowing that your family will be protected, no matter what the future holds. That’s what a reliable safety net provides – a reassuring sense of security that goes beyond your own lifetime.

Finding the best term life insurance can feel like a daunting task. Break it down into smaller, manageable steps, and it becomes more approachable.

What Is Term Life Insurance?

Term life insurance is a life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It’s designed to give your loved ones financial protection if you pass away during the term of the policy.

With term life, you pay a fixed premium for the duration of the term. If you die during that time, your beneficiaries receive a death benefit payout. But if you outlive the term, the coverage ends and there’s no payout.

Here’s the lowdown: term life insurance explained.

Here’s how it works: You choose the coverage amount and term length that fits your needs and budget. Then, you pay a monthly or annual premium to keep the policy in force.

If you die during the term, your beneficiaries file a claim with the insurance company. Once approved, they receive the death benefit tax-free.

Types of Term Life Insurance

In the world of insurance, you’ve got options when it comes to finding the best term life insurance for you and your family.

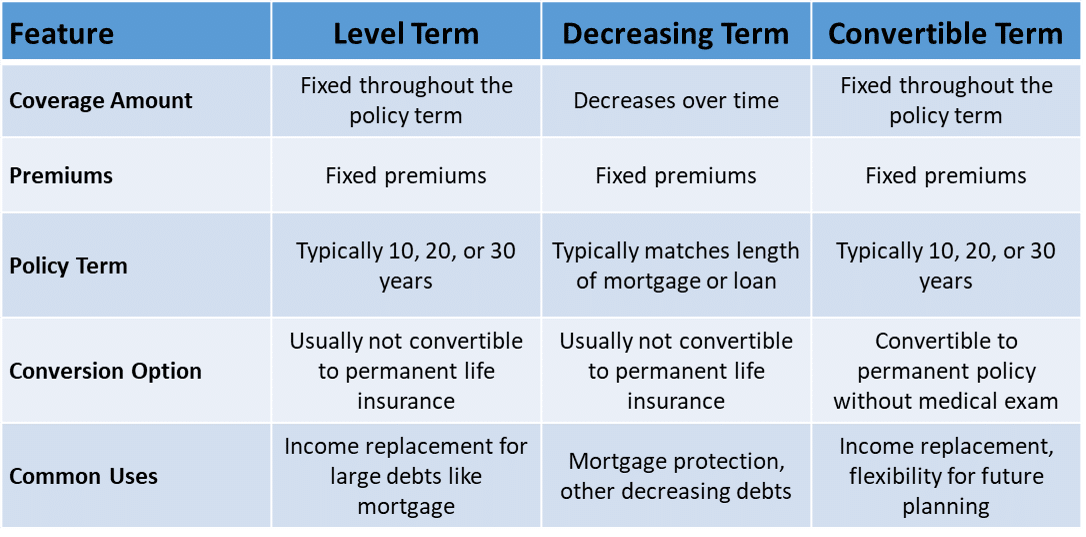

- Level term: The most common type, where the death benefit and premiums stay the same for the entire term.

- Decreasing term: Where the death benefit decreases over time, typically used to cover a debt that’s being paid off, like a mortgage.

- Convertible term : Allows you to convert your term policy to a permanent policy before the term ends, without having to take a new medical exam.

Advantages of Term Life Insurance

Term life insurance is a smart financial move because it only covers you for a set amount of time. This limited coverage period makes it a more affordable option for many people.

A big benefit of short-term policies is the lower premiums. This type of insurance tends to be cheaper than permanent life insurance, which can be a big relief for your wallet.

Term life is also simple and straightforward. There are no investment components or cash value accounts to worry about. You just pay your premiums and have coverage in place.

And if your financial obligations change over time, you can choose a term length that matches. For example, a 20-year term might make sense if you have young children, while a 30-year term could be better if you have a longer mortgage.

How to Choose the Best Term Life Insurance

Russell wasn’t an insurance expert, but when his family grew, he knew he needed a term life insurance policy to keep them protected. After months of research, he finally found a policy that was a perfect fit. You can do the same – don’t let uncertainty hold you back.

Determine Your Coverage Needs

Start by figuring out how much coverage you actually need. A good rule of thumb is to have coverage equal to 5-10 times your annual income. But also consider your debts, future expenses, and any other assets.

Think about what your family would need to maintain their standard of living if you were no longer around. Would they need to replace your income, or pay off the mortgage? Cover college costs?

Having a clear picture of their needs will help you choose the right coverage amount.

Compare Term Life Insurance Quotes

When you’ve got a handle on how much coverage you need, it’s time to sift through quotes from various insurers. Be sure to look beyond the bottom line, though – the cheapest option isn’t always the best. Then, investigate the insurer’s financial standing and customer satisfaction ratings.

You can get quotes online, over the phone, or through an insurance agent. Be sure to compare apples to apples, with the same coverage amount, term length, and any riders you’re considering.

Consider the Financial Strength of the Insurer

When you’re buying life insurance, you want to be confident that the company will be around to pay the death benefit if needed. That’s why it’s important to look at the insurer’s financial strength ratings from independent agencies like AM Best , Moody’s, and Standard & Poor’s.

The best term life insurance is one that lets you sleep better at night knowing your insurer has your back? Look for top-rated companies with A or A+ ratings, and you’ll breathe easier.

Look for Additional Features and Riders

When it comes to beefing up the best term life insurance for your situation, consider adding some extras that’ll give you more bang for your buck. For instance, an accelerated death benefit rider can be a lifesaver if you’re diagnosed with a terminal illness, allowing you to tap into your death benefit early.

Other common riders include accidental death benefit, waiver of premium for disability, and child term riders. If you want the perks of extra protection and flexibility, be prepared to pay a premium – it’s a trade-off that’s worth considering. So consider your needs and budget when deciding which, if any, riders to add.

Factors That Affect Term Life Insurance Rates

Figuring out your term life insurance premium rate involves a bunch of factors. If you want to land on the right insurance policy, you need to understand what they entail – it’s the best way to find a plan that fits your wallet and meets your needs.

Age and Health

Your age and health are two of the biggest factors that affect your term life insurance rates. Generally, younger and healthier applicants qualify for the lowest rates.

Age is more than just a number – it brings a fresh set of health hurdles that insurance providers keep top of mind when calculating premiums. If you’ve got pre-existing health conditions, you might face steeper premiums or even struggle to get coverage in the first place.

Coverage Amount and Term Length

The amount of coverage you choose and the length of the term also impact your rates. Higher coverage amounts and longer terms will generally result in higher premiums.

The insurer is basically shouldering a heavier load by committing to larger payouts over an extended period. So it’s important to choose a coverage amount and term length that fits your needs and budget.

Lifestyle Factors

Smoking is a pricey habit, and it’s not just your lungs that will suffer. When it comes to term life insurance rates, smokers typically face significantly higher premiums compared to non-smokers.

If you’re a thrill-seeker who loves skydiving or rock climbing, your insurer might raise an eyebrow. But there’s a flip side: participating in these activities puts you at risk of getting seriously hurt – or worse still. Your driving record and any criminal history can also impact your rates, as insurers see these as warning signs that you might be more likely to meet an untimely end.

Occupation and Hobbies

Your profession and hobbies can impact your term life insurance rates in surprising ways. For instance, if you work in a high-stakes field like construction or law enforcement, you may face higher premiums due to the increased risk of injury or death on the job.

If you’re an adrenaline junkie who loves extreme sports like scuba diving , flying, or racing, be prepared for higher premiums or potential denial of coverage. Be upfront about your job and hobbies when applying for a policy. If you’re caught hiding the truth, your policy becomes worthless.

Remember this:

Term life insurance provides coverage for a set period, offering financial protection to your loved ones if you pass away during that time. It is affordable and straightforward, with different types like level term, decreasing term, and convertible term available. Choose the right policy by considering your needs and comparing quotes.

Riders and Additional Features to Consider

As you explore your term life insurance options, remember that it’s about more than just the death benefit. For added peace of mind, don’t forget to factor in the extras that can beef up your protection.

Accelerated Death Benefit Rider

An accelerated death benefit rider can be a lifesaver if you’re diagnosed with a terminal illness. It allows you to access a portion of your death benefit while you’re still alive to help cover medical expenses or provide financial support for your family. The best term life insurance policies have one.

From personal experience, I can attest to the impact this rider can have. A close friend of mine was diagnosed with cancer and given just months to live. Thanks to the accelerated death benefit on his policy, he was able to access funds to pay for experimental treatments and spend quality time with his loved ones in his final days.

Accidental Death Benefit Rider

If you work in a high-risk job or have a passion for adventure, an accidental death benefit rider can provide an added layer of financial protection for your loved ones in the event of a fatal accident. You’ll sleep better at night knowing that, come what may, your dependents will be financially protected – a reassuring thought, to say the least.

It’s important to note that accidental death is different from a standard life insurance payout. With an accidental death benefit rider, your beneficiaries would receive both the base policy’s death benefit and the additional accidental death benefit.

Waiver of Premium Rider

A waiver of premium rider can be a smart choice, especially if you’re the primary breadwinner for your family. If you become disabled and unable to work, this rider will waive your insurance premiums while keeping your coverage in force.

I always recommend considering a waiver of premium rider, especially for younger individuals who may not have a large savings cushion to fall back on in case of disability.

Convertibility Option

Having a convertibility option with your term life policy can be a lifesaver if your health takes a turn for the worse. No medical exam required! You can seamlessly transition to a permanent policy without jumping through hoops.

Keep in mind that not all term policies are convertible, and those that are may have restrictions on when you can convert. Be sure to ask about the convertibility option when comparing policies to find the best term life insurance for your needs.

What Happens When a Term Life Insurance Policy Expires?

When you purchase a term life insurance policy, you’re locking in coverage for a set period of time, usually 10, 20, or 30 years. But what happens when that term is up?

Renewal Options

Some of the best term life insurance policies offer the option to renew your coverage after the initial term expires. However, it’s important to note that your insurance rates will likely increase significantly, as they will be based on your age and health at the time of renewal.

For example, if you purchase a 20-year term policy at age 30, your insurance premiums will be much lower than if you renew that same policy at age 50.

Conversion to Permanent Life Insurance

Another option when your term life insurance policy expires is to convert it to a permanent policy, such as universal life or whole life insurance. As long as you keep paying your premiums, you’ll be protected for life – a safeguard against the unexpected.

One of the biggest advantages of converting a term policy is that you get to skip the hassle of a new medical exam and health questionnaire.

Letting the Policy Lapse

Of course, you always have the option to simply let your term life insurance policy lapse when the term ends. If you no longer need coverage or can’t afford the higher insurance rates, this may be the best choice for you.

Just keep in mind that if you decide you need coverage again in the future, you’ll need to apply for a new policy and go through the underwriting process again. And if your health has changed since your original policy, you may face higher insurance premiums or even be denied coverage.

Common Questions About Term Life Insurance

As someone who has worked in the insurance industry for years, I’ve heard my fair share of questions about term life insurance. Here are some of the most common ones I encounter.

How Much Term Life Insurance Do I Need?

The amount of term life insurance you need depends on your individual financial situation and goals. A good rule of thumb is to have coverage equal to 5-10 times your annual income. However, you should also consider factors like outstanding debts, future expenses (such as your children’s education), and your family’s long-term needs.

To find the best term life insurance policy, I always suggest a sit-down with a financial whiz or insurance pro. Numbers won’t intimidate you with their help – they’ll guide you through the policy options to find one that slipped effortlessly into your budget.

Can I Change My Coverage Amount?

Most term life insurance policies allow you to decrease your coverage amount if your needs change. For example, if you pay off your mortgage or your children graduate from college, you may not need as much coverage.

However, increasing your coverage amount is trickier. In most cases, you’ll need to apply for a new policy and undergo a medical exam again.

What If I Outlive My Term Life Policy?

If you outlive your term life insurance policy, the coverage simply expires. You won’t receive any payout, but you also won’t owe any additional premiums.

At this point, you’ll need to decide whether you still need life insurance coverage. If so, you can shop for a new policy or consider converting your term policy to a permanent one.

Are There Any Exclusions to Coverage?

Like all insurance policies, term life insurance has some exclusions. These can vary by insurer but typically include things like death by suicide (usually within the first two years of the policy) or death while engaging in illegal activities.

When you buy a policy, you might encounter a contestability period, which typically lasts one to two years. During this time, your insurer has the right to scrutinize your application and even deny claims if they suspect fraud or misinformation.

To avoid any surprises down the line, be sure to read your policy documents carefully and ask questions if anything is unclear. And always be honest on your life insurance application – it’s not worth risking your coverage to save a few dollars on premiums.

So, what’s the main idea?

Consider adding riders like accelerated death benefit, accidental death benefit, waiver of premium, and convertibility options. Flexibility and protection get a boost with these features, all carefully crafted to meet your unique situation.

Finishing touches have been applied, and we’ve reached the final stage.

That’s the takeaway – plain and simple. The lowdown on the best term life insurance . For your family’s future, one crucial choice stands out – and it’s not exactly electrifying, but quietly pivotal.

Remember, the best term life insurance is a financial safety net. It’s there to catch your loved ones if something happens to you.

Don’t put it off any longer. Take the time to research, compare, and find the best term life insurance for you. Knowing you’ve got their backs, no matter what, is a feeling like no other.