Contents

- What is a Life Insurance MIB Report?

- How Does The Life Insurance MIB Report Work?

- What Does a Life Insurance MIB Report Include?

- How Long Does Information Stay on an MIB Report?

- How to Access and Correct Your MIB Report

- Key Takeaways

- Role of Individual Life Insurance Policies Issued

- Role in Income, Critical Illness, and Long-Term Care Insurance

- Role in Disability Income, Critical Illness, and Long-Term Care Insurance

- Role with Major Insurance Companies

- Role in HIPAA Regulations

- Role with Reporting Companies

- Role in Conducting Reasonable Investigations

- Role in Collecting Information

- Role with Consumer Reporting Companies

- Role of Reporting Company

- Accessing MIB

- Role in Life Insurance Applications

- Role with Consumer Files

- Conclusion

Getting life insurance can feel overwhelming, especially when you hear about things like the “Life Insurance MIB report.” You might wonder what it is and if it will affect your application. We’re going to explain exactly what a Life Insurance MIB report is, how to verify information in your MIB file, and what to do if you find inaccurate information in your MIB file.

What is a Life Insurance MIB Report?

The MIB Group, formerly known as the Medical Information Bureau, is a central information hub. Most life insurance companies in the U.S. and Canada use MIB. It’s kind of like a credit report but for medical information related to insurance applications.

The MIB report includes information about previous life, health, disability income, critical illness, and long-term care insurance applications. This helps insurance companies assess risk and detect potential fraud. Think of it as a safeguard for both you and the insurance company.

To be clear, MIB doesn’t store your personal medical records – your privacy is important. The information is coded and stripped of identifying details like your name or address. MIB codes keep track of medical history and other information related to previous applications for insurance. It helps insurance companies share essential information about your application without compromising your identity.

How Does The Life Insurance MIB Report Work?

How does a Life Insurance MIB report fit into getting a policy? Let’s break down the process:

Applying for Life Insurance

Imagine you decide to get life insurance. You contact a life insurance company and start filling out an application. As part of the process, you allow the insurance company to access your MIB report.

Insurance Company Checks Your Report

The insurance company will contact the MIB. The insurance company will compare the information on your application with information you provided on other applications for insurance coverage. The insurance company is looking for inconsistencies or red flags related to your medical history.

Life Insurance MIB Report is Generated

MIB then creates a report. The report is based on the data it’s gathered from other insurance companies, which is then sent to the insurer you have applied for coverage. This report contains codes relating to your past insurance applications.

Assessment and Underwriting

With the MIB report in hand, insurance companies cross-reference the codes in the report with your current application. This gives insurance underwriters a complete understanding of your medical history.

Factors like your height/weight ratio, driving record, and family medical history are also considered. The insurer uses this information to determine your individual life insurance policy eligibility and premium rates.

What Does a Life Insurance MIB Report Include?

A Life Insurance MIB report contains information strictly related to your insurance history. There are things you may be surprised to learn are in your file. The MIB report includes:

- Dates and types of previous life insurance, health insurance, disability insurance, and long-term care insurance applications.

- Information on policies issued.

- Medical conditions that have been reported.

- History of risky hobbies, such as skydiving or scuba diving.

The report helps insurance companies assess your insurability. They consider various factors related to your health and lifestyle to determine your premiums and coverage.

How Long Does Information Stay on an MIB Report?

A common question is: “How long does information stay on my MIB report?” Information generally stays on your Life Insurance MIB report for seven years from the date it was reported. This time frame makes sure insurance companies have access to relevant and recent medical information when assessing applications. It also helps combat fraud by tracking previous applications and policies issued.

How to Access and Correct Your MIB Report

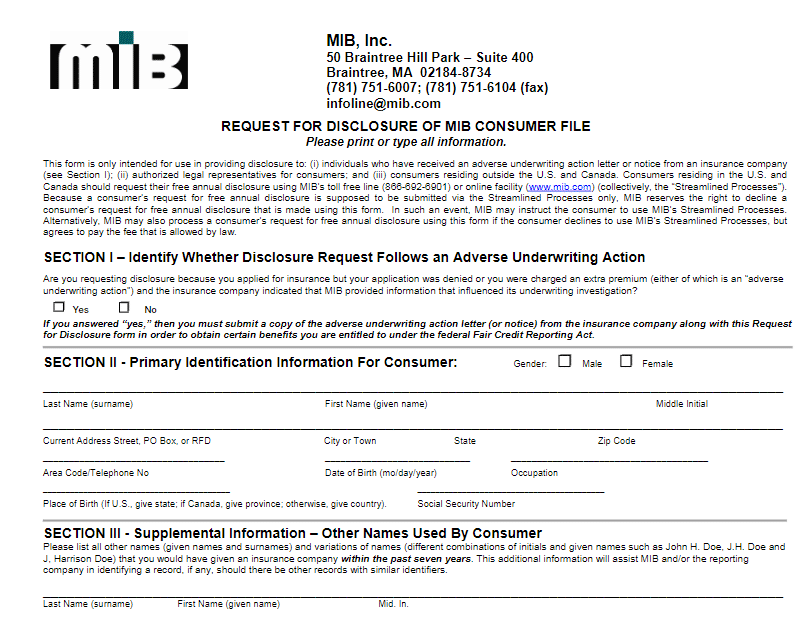

People are often concerned with what’s on their report and many want to know, “How do I access my MIB report?” The Fair Credit Reporting Act (FCRA) gives you the right to request a free copy of your report. You can submit an online form on MIB’s website or call them directly at (866) 692-6901.

You can get a free copy every 12 months. Requesting your report doesn’t impact your credit score.

If you find an error after receiving your MIB report, don’t worry. The FCRA gives you the right to challenge inaccuracies. You are entitled to one free report every 12 months if requested.

Use MIB’s online dispute process. After review, they will correct any incorrect information and update their records – including those sent to insurance companies within the past seven years.

Key Takeaways

Role of Individual Life Insurance Policies Issued

MIB plays a crucial role in the context of individual life insurance policies by facilitating information exchange among member insurance companies. This helps insurers assess risk accurately and prevent fraud by accessing historical data on applicants.

Role in Income, Critical Illness, and Long-Term Care Insurance

MIB assists in the realm of income protection, critical illness, and long-term care insurance by providing data that insurers use to evaluate applicants’ health histories. This helps in underwriting these specialized insurance policies effectively.

Role in Disability Income, Critical Illness, and Long-Term Care Insurance

MIB supports disability income insurance, critical illness insurance, and long-term care insurance by supplying relevant medical and health information about applicants. Insurers use this data to assess risk and determine appropriate coverage terms.

Role with Major Insurance Companies

MIB collaborates closely with major insurance companies, serving as a centralized repository of medical and other pertinent information that helps these insurers make informed underwriting decisions.

Role in HIPAA Regulations

MIB adheres strictly to HIPAA (Health Insurance Portability and Accountability Act) regulations, ensuring that all medical information shared is handled with the utmost confidentiality and compliance with federal privacy laws.

Role with Reporting Companies

MIB works with reporting companies to gather and exchange information on individuals applying for insurance, ensuring a comprehensive view of an applicant’s medical and insurance history.

Role in Conducting Reasonable Investigations

MIB conducts reasonable investigations into discrepancies or red flags identified during the insurance application process, helping insurers validate information and prevent fraudulent claims.

Role in Collecting Information

MIB collects and stores relevant medical and non-medical information provided by member insurance companies, maintaining a secure database that supports fair and accurate insurance underwriting.

Role with Consumer Reporting Companies

MIB interacts with consumer reporting companies to exchange data and ensure comprehensive risk assessment for insurance applicants.

Role of Reporting Company

Reporting companies collaborate with MIB to furnish accurate and up-to-date information on applicants, enhancing the integrity and reliability of the underwriting process.

Accessing MIB

Insurance companies access MIB to obtain pertinent information during the underwriting process, ensuring a thorough evaluation of an applicant’s risk profile.

Role in Life Insurance Applications

MIB supports life insurance applications by supplying insurers with comprehensive data on applicants, facilitating informed decision-making in underwriting life insurance policies.

Role with Consumer Files

MIB manages consumer files containing relevant information used by insurers to assess risk and determine appropriate coverage, ensuring fair and equitable treatment of insurance applicants.

Each of these roles underscores MIB’s critical function in the insurance industry, promoting fairness, accuracy, and efficiency in the underwriting process while safeguarding consumer privacy and compliance with regulatory standards.

Conclusion

The Life Insurance MIB report is important in the life insurance application process. It helps companies fairly assess risk by considering all relevant information, including medical conditions, previous applications, and lifestyle factors.

Understanding how it works, what it includes, and how to access and correct your information is an important step in getting the best coverage at the best cost possible.