You might have life insurance to protect your loved ones if you die. But have you ever considered what would happen if you were diagnosed with a critical illness and couldn’t work? Or if a health issue kept you from your passions, like gardening with your children or walking the dog with your spouse? A critical illness rider, which you can add to your life insurance policy, would help.

According to the American Association for Critical Illness Insurance, a staggering one in three people will have to deal with a critical illness during their lifetime. This often leads to lost income, significant medical expenses, and the need to adapt to lifestyle changes. Let’s examine how a critical illness rider can offer crucial financial assistance to navigate these challenges.

What is a Critical Illness Rider and How Does It Work?

A critical illness rider is an add-on to a life insurance policy that provides financial benefits while you’re alive if you get diagnosed with a specific illness. Let’s be clear: these aren’t minor illnesses like the common cold. These are life-altering illnesses like cancer, heart attacks, strokes, and major organ transplants.

Imagine the diagnosis comes, and with it, the emotional stress. And then come the medical bills. Will your health insurance cover it all? Maybe not. Cancer treatment alone can reach about $150,000.

This is where a critical illness rider steps in. Upon diagnosis, a critical illness rider allows you to withdraw a portion of your death benefit to use while you’re still alive. It acts as a safety net so you can focus on recovering rather than worrying about finances. You can use these funds to help with various things like:

- Medical expenses that your health insurance may not cover.

- Lifestyle modifications (like home healthcare or therapy) to manage the impact of the illness.

- Replacing income if you’re unable to work due to illness.

- Covering your mortgage or other debts so you don’t lose your financial security.

Why a Critical Illness Rider Can Be a Smart Choice

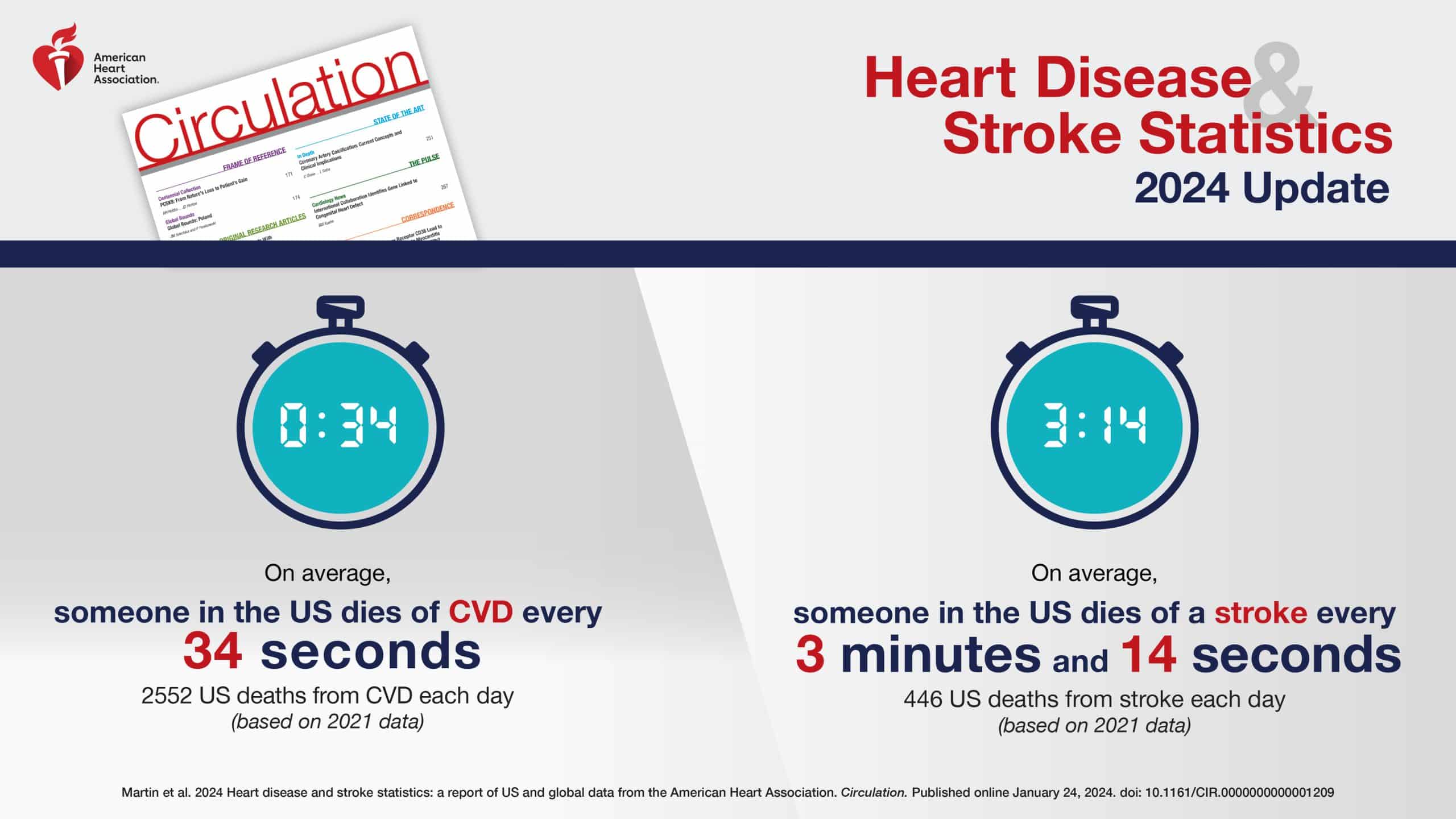

Let’s talk facts. Stroke affects almost 800,000 Americans each year , often leading to disabilities during adulthood. The added benefits a critical illness rider provides you better prepare your family for an unplanned critical illness.

Think about how it would impact your family. If a critical illness were to occur, it would be incredibly difficult also to bear a financial burden. It’s not about planning for the worst – it’s about having a backup plan when life takes an unexpected turn. The American Association of Critical Illness Insurance says one in three people face a critical illness in their lifetime. These critical illnesses also account for nearly 70% of all deaths in the United States.

Types of Critical Illnesses Covered

Although policies can vary, here are some common critical illnesses covered:

- Cancer,

- Heart Attack,

- Stroke,

- Kidney Failure,

- Major Organ Transplant,

- Paralysis,

- Coronary Artery Bypass Surgery.

- ALS (Lou Gehrig’s disease).

While I can list several illnesses, you should consult a qualified insurance professional for specific policy benefits and your needs.

Do You Need a Critical Illness Rider?

That’s a good question, and honestly, it’s personal. But think of it this way. What if you are diagnosed with a covered illness during your policy term?

Do you have money to cover the loss of income and additional expenses likely to occur? Even if you have the extra savings, wouldn’t you rather use that money for something else? With a critical illness insurance rider, you would receive a lump sum to help with treatment and living expenses and decide how to spend it—there are no restrictions.

Is It Worth It?

The price of a critical illness rider is determined by several factors, including your age, health, coverage amount, and family’s medical history. There are, however, a number of term insurance and permanent insurance life policies that include a critical illness rider at no additional premium cost.

Disability and critical illness insurance are two important forms of coverage that provide financial protection in the event of health-related setbacks.

Disability insurance typically offers income replacement if you cannot work due to a disability caused by illness or injury. It ensures a steady stream of income to cover living expenses and medical costs during your recovery period.

Critical illness insurance, on the other hand, provides a lump-sum payment upon diagnosis of a covered critical illness, such as heart attack, stroke, cancer, or organ transplant. This lump sum can cover medical expenses, ongoing care, or even lifestyle adjustments.

Insurance companies offer various types of policies and plans tailored to different needs. Critical illness coverage can be obtained as a standalone policy or as a rider to a life insurance policy. These riders typically enhance the base policy by providing additional benefits for critical illnesses.

When considering insurance coverage, it’s important to review policy details carefully. Some policies may require a medical exam to assess your health status and determine coverage eligibility. Others, such as guaranteed issue policies, may offer coverage without needing a medical exam.

Critical illness riders typically outline specific illnesses covered, which may include heart attacks, strokes, and certain types of cancer. The sum assured or benefit amount varies depending on the policy and the severity of the illness.

In addition to critical illness coverage, some insurance policies offer living benefits for terminal illnesses. These benefits provide financial assistance while the insured is still alive and facing a terminal diagnosis, helping to manage medical expenses and maintain quality of life.

Insurance companies strive to provide comprehensive coverage that meets diverse health conditions and needs. Understanding the specifics of your policy, including any riders or supplemental coverage, ensures that you have adequate protection against unexpected health challenges.

Understanding various insurance riders can greatly enhance the flexibility and comprehensiveness of your coverage:

Chronic Illness Rider

This rider allows you to access a portion of your life insurance death benefit if you are diagnosed with a chronic illness that meets the policy’s criteria. It provides financial support to cover medical expenses and ongoing care associated with chronic conditions.

Guaranteed Insurability

This rider enables you to purchase additional life insurance coverage at specific intervals or life events (such as marriage or the birth of a child) without needing a medical exam or proof of insurability. It ensures you can increase your coverage as your needs change, even if your health has declined since purchasing the policy.

Long-Term Care Rider

A care rider supplements your life insurance policy by offering benefits that can be used to cover long-term care expenses, such as nursing home care or home health care services. It helps protect your assets and provides financial security if you require extended care due to aging, illness, or injury.

Accelerated Death

This benefit allows you to receive a portion of your life insurance death benefit in advance if you are diagnosed with a terminal illness. It provides financial assistance to cover medical expenses and improve quality of life during the end-of-life period.

Understanding these riders and their benefits can help you tailor your insurance coverage to meet your current and future financial needs. It’s essential to review your policy details carefully and consult with an insurance professional to ensure you have the right mix of coverage and riders to protect yourself and your loved ones effectively.

Choosing the Right Critical Illness Rider

When selecting a critical illness rider, it’s essential to understand several key factors to find the coverage that best suits your needs.

Coverage

Not all riders cover every single critical illness, although most include heart attack, stroke, and cancer. So look beyond these basics and see what else your rider includes. Make sure it covers any illness prevalent in your family. For instance, some might include coverage for organ transplants, while others don’t. Thoroughly compare the definitions of illnesses to ensure you meet the specific criteria to use the benefit, as these may vary across different companies.

Benefit Amount

You’ll need to think about how much coverage is needed. Determine how much your death benefit would reduce upon receiving a payout. For instance, if you’re diagnosed with a qualifying condition and the rider benefit is $50,000, your life insurance payout will be reduced by $50,000. For example, a $500,000 policy will decrease to $450,000 after you receive the critical illness benefit. Carefully analyze whether to include a potential payout in your total policy amount.

Waiting Period

Understand any waiting periods because those are standard before coverage starts. Some policies may impose a waiting period from when you’re issued the policy to when you can file a claim for certain conditions. Pay close attention to these time frames and choose a policy that offers coverage as early as possible. Also, ask if there’s a survival period involved. Some policies might require you to survive for a specific duration after diagnosis before receiving the payout, generally ranging from 14 to 30 days. Be sure to pick an option with a manageable survival period, taking into account potential illness timelines.

Exclusions

This is huge: be aware of potential exclusions or limitations in coverage. The rider may specify pre-existing medical conditions that may partially or entirely exclude you from benefits. Ask yourself – will it adequately support you and your loved ones when they need it most? Does it offer the peace of mind that your financial future is a bit more secure, no matter what curveballs life throws your way?

Conclusion

Adding a critical illness rider to your life insurance policy can give you a financial cushion during an already challenging time. Ultimately, whether it is worthwhile comes down to individual needs and priorities. However, having a basic grasp of a critical illness rider allows you to engage in informed conversations. It also gives you peace of mind.