The Quility Secure Future Preferred (QSFP) life insurance policy, underwritten by American-Amicable Life Insurance Company of Texas, is a newly released final expense whole life insurance product. Marketed for its simplicity and speed, this instant issue final expense policy can be approved and delivered in less than 10 minutes, making it an attractive option for those seeking quick and reliable coverage.

Key Features

Instant Issue Final Expense Policy

QSFP boasts one of the fastest application processes in the industry, with instant issuance capabilities. This feature is particularly beneficial for clients who need immediate coverage without the hassle of a medical exam and physician records.

Target Demographic:

This policy is designed for healthier individuals aged 50 to 85. It caters to those who want higher face amounts of permanent coverage, making it suitable for covering final expenses, protecting against financial loss, and ensuring mortgage payments.

Coverage Amounts:

The policy is uniquely positioned to serve the needs of today’s seniors who require more than the traditional $5,000 to $25,000 in coverage. An 85-year-old in good health can qualify for a $100,000 policy. Face amounts are available, ranging from $5,000 to $100,000. Maximum coverage limits are:

- $50,000 for Standard classes.

- $75,000 for Preferred Non-Tobacco.

- $100,000 for Preferred Plus Non-Tobacco.

Underwriting Classes:

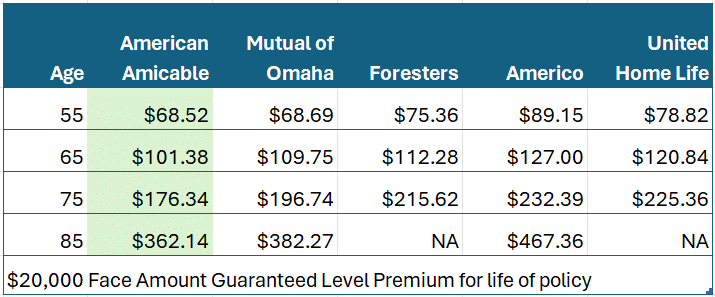

Available underwriting classes include Standard Non-Tobacco, Tobacco, Preferred Non-Tobacco, and Preferred Plus Non-Tobacco. Because American Amicable offers multiple underwriting classes, premiums under the best underwriting class are among the most competitive in the industry for an instant issue final expense plan.

Riders and Benefits:

The QSFP includes optional riders such as Terminal Illness and Confined Care. Both riders allow you to receive up to 100% of the death benefit while you are still living when diagnosed with a terminal illness or are confined to a nursing home for more than 30 days.

A Charitable Giving Rider is also available, which allows policyholders to designate a 501(c)3 organization to receive a donation upon the policyholder’s death at no extra cost.

Accessibility:

The life insurance policy is available in all states except New York.

Payment Options:

Flexible payment frequency options include monthly, quarterly, semi-annual, and annual payments. Accepted payment types include E-check and Bank Drafts.

Underwriting Details for Instant Issue Final Expense:

Build Charts: The QSFP has specific height/weight charts for different age groups and underwriting classes. For example, for ages 50-70 in the Standard class, the weight range varies by height, with a 5’10” individual required to weigh between 120 and 289 pounds. The Preferred Plus class has slightly stricter requirements, with a person 5’10” needing to weight between 126 and 265 pounds.

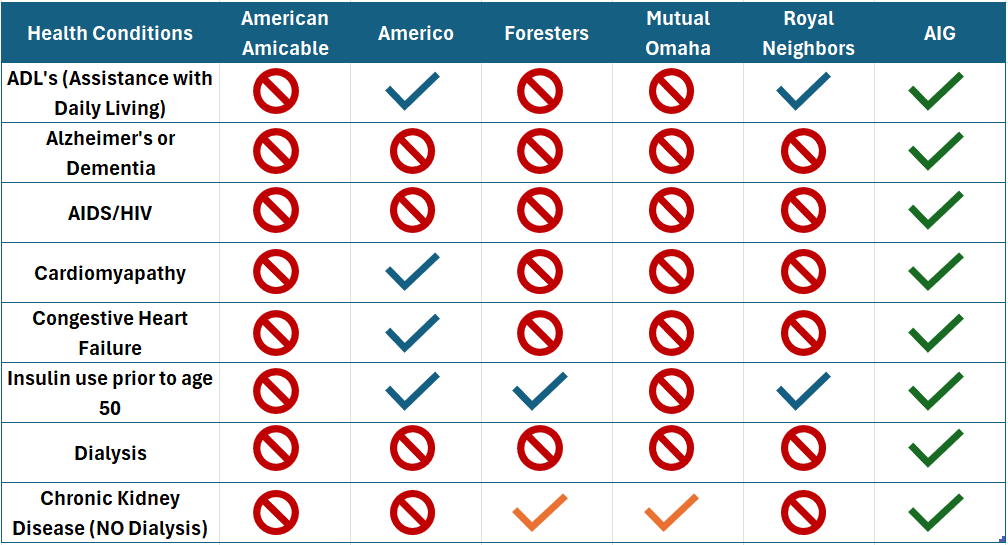

Declinable Conditions: Certain medical conditions and histories will result in a declination of coverage. These include but are not limited to Congestive Heart Failure, Cardiomyopathy, AIDS, HIV, Kidney Dialysis, Insulin use before age 50, Alzheimer’s, Dementia, organ transplants, and multiple occurrences of cancer.

Prescription Reference Guide: The prescription reference guide lists medications that, if taken for specific conditions, will result in a declination of coverage for life insurance. Conditions such as schizophrenia, bipolar disorder, stroke, Parkinson’s disease, and certain types of cancer within specific time frames are among the factors considered.

Pros:

- Quick Issuance: The ability to issue a policy in under 10 minutes is a significant advantage, reducing the time and hassle of getting client coverage approved.

- Comprehensive Coverage Options: Offers among the broadest range of face amounts and underwriting classes to cater to the varied needs of today’s seniors.

- Very Attractive Premiums: This is for clients who qualify for the Preferred Plus underwriting class.

- Additional Benefits: This plan includes valuable riders like the Terminal Illness, Confined Care, and Charitable Giving Rider at no extra cost.

- Flexible Payments: Various payment frequency options and types provide convenience for policyholders.

Cons:

- Age Limitations: The policy is only available for individuals aged 50 to 85, which may exclude seniors older than 85 seeking final expense coverage.

- State Restrictions: Not available in New York, which limits accessibility for residents of that state.

- Fully Underwritten: This instant issue final expense policy is fully underwritten using medical questions. Specific medical conditions and prescription medications can result in declination, limiting accessibility for some applicants with severe medical conditions.

Customer Experience:

The application process is streamlined with digital signatures for HIPPA Authorization and application completion. Policies are delivered electronically, with a physical copy sent if not accessed within 15 days.

Conclusion:

The Quility Secure Future Preferred life insurance policy by American Amicable stands out for its rapid issuance process, high face amounts, comprehensive coverage options, competitive premiums for healthier seniors, and valuable additional benefits. It is an excellent choice for healthier individuals between 50 and 85 who need comprehensive final expense coverage.

However, for seniors over 85 or living in New York, other life insurance carriers and plans need to be considered. Also, because this instant issue final expense policy is fully underwritten, seniors with significant medical history are better served to look for a policy with simplified underwriting or guaranteed issue.

For those who qualify, the QSFP provides some of the highest coverage limits and lowest premiums of any final expense policy available to seniors in the market today.