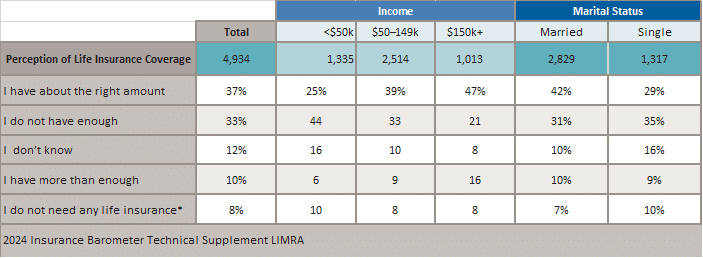

Feelings about life insurance by marital status.

As a single individual, it’s easy to overlook life insurance as part of your financial plan, but it’s a crucial aspect that should never be ignored. Is life insurance for single people needed if you don’t have children or a spouse relying on your income? If you own a business, have assets and debt, or aging parents or siblings who rely on your income for support, life insurance needs to be part of your financial plan.

Understanding the importance of life insurance for single people gives you power to safeguard yourself and the people you care about against creditors, probate sharks, or tax raiders. This is especially important given your circumstances will likely change over time. Even though you may be single today with no-one relying on you for support, life happens.

Why Life Insurance Is Important for Single People

Life insurance for single people is more important than you might think. Just because you don’t have a spouse or kids doesn’t mean you don’t need coverage.

I’ve seen firsthand how life insurance can make a huge difference for single people and their loved ones. It’s not just about covering final expenses, although that’s certainly a big part of it.

With life insurance as a single person, you can confidently walk away from everyday worries, knowing your financial mishaps won’t leave a crushing weight on those closest to you. Your future won’t be overshadowed by nagging debt; instead, it’ll be illuminated by clarity and reassurance.

For single individuals, having life insurance is crucial for securing a financial future, regardless of age. It’s not just about insuring against financial loss, but also about empowering oneself with financial protection.

- To cover end-of-life expenses like funeral costs.

- To pay off student loans, credit card debt, or a mortgage.

- To provide financial support for aging parents or siblings.

- To leave a financial legacy to a charity or cause you care about.

The type of life insurance you need as a single person depends on your specific situation. Term life insurance is often the most affordable option, but permanent policies like whole life can provide lifelong coverage and build cash value.

What do you need to do to ensure you have the right life insurance coverage? First, use an insurance calculator to assess your income, debts, and final expenses. Don’t wait, as the earlier you buy life insurance, the more you’ll save.

Situations Where Life Insurance for Single People is Needed

Future Insurability

An unfortunate fact of most insurance coverage is that you have to buy coverage before you need it. You can’t wait until after you get in a car accident before you buy auto insurance. A life insurance policy works the same way.

Purchasing life insurance while you are young and healthy can lock in lower rates, making it more affordable if your health declines in the future. Adding a guaranteed insurability rider can allow you to purchase additional coverage in the future without further medical underwriting. You are guaranteed this coverage even if your health or circumstances change.

Supporting Family Members

Just because you’re single doesn’t mean you don’t have people depending on you financially. Maybe you help support your aging parents or a sibling with a disability. Life insurance can make sure they’re taken care of if something happens to you.

As a primary caregiver for their elderly parents, many of my clients have wisely purchased life insurance to prepare for future care needs. This thoughtful planning for their financial dependents gives them a tremendous sense of comfort.

Paying Off Debts

Student loans, credit card balances, car loans, mortgages – most of us have some kind of debt. And here’s the thing, that debt doesn’t just disappear if you die. It becomes the responsibility of your estate and sometimes your family.

A life insurance policy can pay off those debts so they don’t become a burden to the people you love most. This is especially important if you have private student loans that were co-signed by a parent or relative.

Protecting a Business

If you’re a small business owner, life insurance can be a lifeline for your company. It can provide the funds to keep things running, hire a replacement, or buy out your shares if you have a business partner.

A life insurance policy can also be used to provide security for a business loan. You can assign the death benefit and any cash value as collateral for the loan and remove the assignment when the loan is repaid.

Leaving a Legacy

A meaningful legacy is about more than mere mortal gain; it’s about leaving a mark on the world that reflects our character. Life insurance can help create a perpetual legacy by providing a steady stream of support to the causes that ignite our hearts.

You can name a favorite charity, school, or foundation as a beneficiary on your life insurance policy. Imagine the difference you could make with a generous donation from beyond the grave. That’s a legacy worth leaving.

Types of Life Insurance Policies for Single Individuals

Term Life Insurance for Single People

Term life insurance is the simplest and most affordable type of coverage for most single people. You choose a term length (like 10, 20, or 30 years) and a coverage amount (like $250,000 or $1 million). If you die during the term, the policy pays out to your beneficiaries.

The biggest advantage of term life is the low cost. Because it only covers you for a set period, the risk to the insurer is lower, so premiums are more affordable. This is a great option if you just want basic protection while you’re young and healthy and want to guarantee your future insurability.

Whole Life Insurance for Single People

Whole life insurance doesn’t discriminate with its durability; this policy sticks with you for the duration of your life. Unlike term insurance, it’s an anchor that holds steady through all the ebbs and flows. As it grows, the cash value component becomes a benefit-filled foundation, allowing you to tap into it for needs big and small.

The premiums for whole life are higher than term, but they are guaranteed to stay level for life. This can be a smart option for single people who want lifelong coverage and are interested in building a cash reserve. The additional premium provides added security and investment.

Indexed Universal Life Insurance for Single People

Universal life insurance is another type of permanent policy that offers more flexibility than whole life. You can adjust your premiums and death benefit over time as your needs change. It also has a cash value component, but with the potential for higher growth tied to market performance.

Financial instability can create a ripple effect in one’s life, particularly for singles. Taking the reins with a universal life policy can provide a cushion against financial turbulence. This policy type needs to be designed, set up, and funded correctly to maximize the benefits of indexed universal life.

Final Expense Insurance for Single People

Final expense insurance is a small whole life policy designed to cover end-of-life costs. It’s often marketed to seniors, but single people of any age can purchase it. The coverage amounts are typically lower (under $50,000) and the premiums are fixed.

Juggling funeral expenses without maxing out your insurance policy? Look no further than final expense insurance. This simple, budget-friendly coverage provides peace of mind and security for the person arranging your funeral services.

No matter which type of life insurance you choose as a single person, the most important thing is to have coverage. Don’t leave your loved ones unprotected or your legacy to chance. Life insurance for single people is an essential part of any smart financial plan.

Key Takeaway:

As a single person, buying life insurance is like building a safety net – it ensures your loved ones aren’t left with financial burdens and that your hard-earned assets go where you want them to, giving you peace of mind and a clear conscience.

How to Determine the Right Amount of Life Insurance Coverage

When it comes to life insurance, it’s not just about being in a romantic relationship. Singles can also benefit from having the right coverage in place. To find the perfect amount for yourself, consider your financial obligations and goals.

Calculating Living Expenses

Start by adding up your current living expenses. This includes things like rent/mortgage payments, utilities, food, transportation, and any other regular bills. Don’t forget to factor in future expenses too, like if you plan to buy a house or have kids someday.

I remember when I first sat down to calculate my living expenses for life insurance purposes. It was eye-opening to see how much I actually needed to cover.

Considering Debts and Assets

Next, make a list of all your debts (like student loans or credit card balances) and assets (like savings or investments). Subtract your assets from your debts to see how much additional coverage you’d need to pay off everything.

When I did this, I realized I needed a bit more coverage than I originally thought. I had some lingering student loan debt that I wanted to make sure wouldn’t be a burden on anyone else.

Planning for Future Dependents

Even if you don’t have dependents now, think about your future plans. Do you want to get married? Have biological children? Take care of aging parents? Factor in potential expenses for anyone who might depend on your income later on.

If you are not married yet, but want a family someday make sure you include enough coverage for things like your future spouse’s living expenses and child’s college tuition. Better to be prepared.

Using Life Insurance Calculators

If all these numbers are making your head spin, don’t worry. There are plenty of online life insurance calculators that can help. They’ll walk you through the process step-by-step and give you a personalized coverage estimate.

The bottom line? Don’t leave your life insurance coverage to chance. Taking the time to crunch the numbers now can give you (and the people you care about) peace of mind for the financial future.

Steps to Buy Life Insurance as a Single Person

Life insurance – a topic many of us put off thinking about, especially if we’re single. But if you’re like me, you’ve come to the realization that life insurance is a smart move, regardless of your relationship status. So, how do you navigate the process of buying life insurance when flying solo?

Assessing Your Life Insurance Needs

First, figure out how much coverage you actually need. Calculate your living expenses, debts, assets, and any potential dependents. This will give you a rough idea of the coverage amount to shoot for.

I know it sounds morbid to plan for your own death, but trust me – your loved ones will appreciate not having to worry about money while they’re grieving. Plus, the younger and healthier you are, the cheaper your life insurance rates will be.

Comparing Insurance Providers

Once you have a coverage amount in mind, it’s time to start shopping around. Look for reputable insurers with a history of financial stability (you can check their ratings on sites like A.M. Best or Standard & Poor’s).

Don’t just go with the first company you find – get quotes from a few different providers to compare prices and coverage options. And read the fine print carefully before signing anything.

When shopping for an insurance policy, I made a point to seek out companies that have a good track record of insuring single people. This was important to me because some insurance providers cater more to families, and I wanted to find one that truly understood my needs and could offer an affordable policy.

Choosing the Right Policy

There are two main types of life insurance: term and permanent. Term is cheaper and covers you for a set period (like 10, 20, or 30 years). Permanent life insurance lasts your whole life and includes an investment component.

For most single people, term life is the way to go. It’s affordable, easy to understand, and you can choose a term length that matches your longest financial obligation (like a mortgage).

Completing the Application Process

To apply, you’ll need to provide some personal info and health history. The insurer may also require a medical exam (they’ll send a nurse to you).

It’s important, to be honest about any health issues or risky hobbies – lying on your application can invalidate your coverage. And definitely don’t put off the medical exam. The longer you wait, the more likely you are to develop a health issue that could raise your insurance rates.

Feeling a sense of anxiety while applying for life insurance is natural. However, think of it as an opportunity to lock in your peace of mind. With specialized policies like Guaranteed Issue Life Insurance available, the possibility of simplified qualification is more achievable than you might think.

The most important thing is to be proactive about your life insurance needs, even if you’re a single person. Trust me – your future self (and loved ones) will thank you for providing financial security with a life insurance policy.

Key Takeaway:

Multiply your financial security by adding up your living expenses, debts, and assets to determine the right amount of life insurance coverage – think of it as calculating the blueprint for your financial future.

Conclusion

Life insurance for single people is an essential component of a well-rounded financial plan. By taking the time to assess your needs and explore your options, you can ensure that your loved ones are protected and your legacy is secure.

In many ways, life insurance is a risk-management strategy that benefits not just your dependents, but also yourself. By investing in term life insurance or whole life insurance, you’re making a proactive decision to safeguard your financial stability and peace of mind.

Don’t wait until it’s too late to protect the people and causes you care about. Embrace the power of life insurance for single people and take control of your financial destiny today.